Traditional Medicare. Medigap. Medicare Advantage. Medicare Parts A, B, C, D, G, etc. Open Enrollment kicks off every year on Oct. 15 and it can be more than a little confusing, especially if it’s your first time navigating the process. Deciding on a Medicare plan is a big decision, and one that can impact you and your family for years to come.

Understanding your Open Enrollment decisions

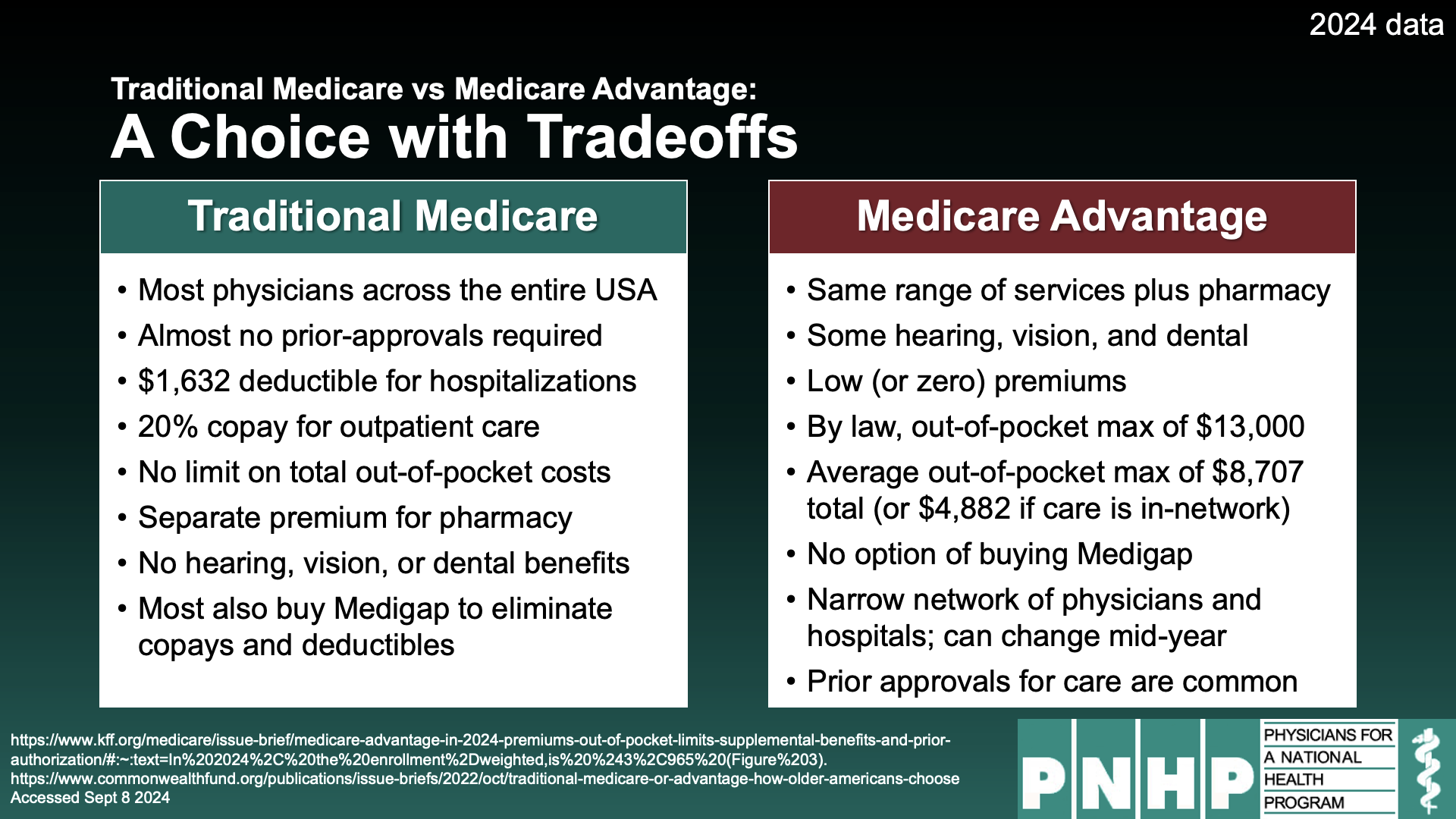

For most people on Medicare, cost is an an important consideration. Advantage plans tend to offer lower monthly premiums whereas Traditional Medicare plans with a Medigap supplemental policy virtually eliminate out-of-pocket costs. Traditional Medicare requires a separate prescription drug plan while Advantage plans require prior authorization for many procedures and often deny medically necessary care.

See a full breakdown using our Traditional Medicare vs. Medicare Advantage comparison chart HERE.

State Health Insurance Assistance Program

Insurance brokers also offer guidance on Medicare enrollment, but buyer beware! While there are many honest brokers out there, the federal government tips the scales by allowing insurance corporations to pay substantially higher commissions for Advantage plans than for Medigap supplemental plans ($611 vs. $352). Brokers have a financial incentive to steer people towards privatized plans.

Thankfully, the State Health Insurance Assistance Program—which is federally-funded, state-run, and powered by volunteer counselors—offers unbiased advice to people enrolling in Medicare. Their counselors have no financial interest in which plan you choose, and are especially helpful when it comes to selecting a Part D prescription drug plan or navigating Medigap.

Ready to take action? Sign our petition demanding Congress protect Medicare beneficiaries by cracking down on insurance company abuses, and by significantly improving the traditional, public Medicare program. Questions? Email organizer@pnhp.org.